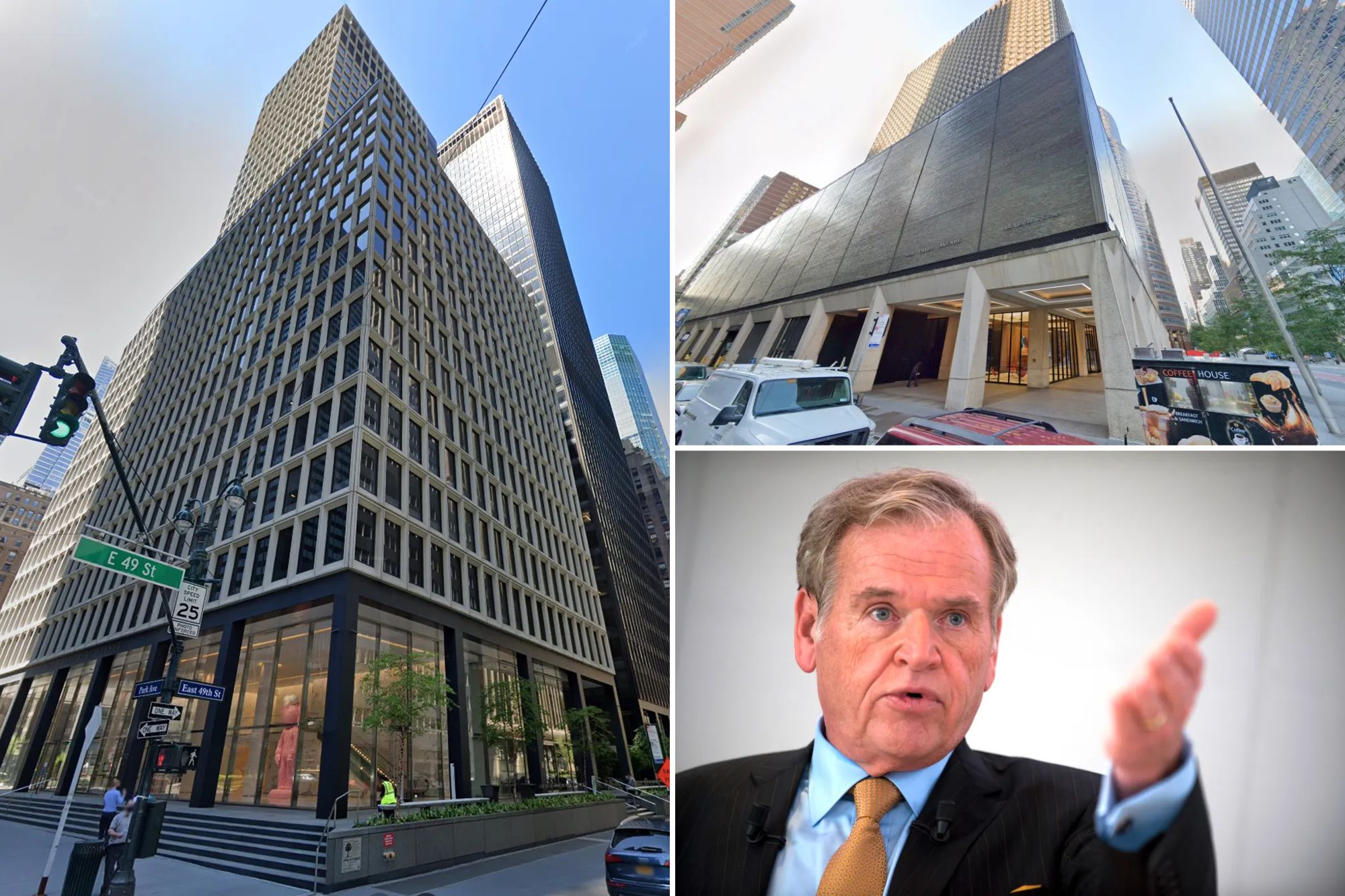

Advertising giant Omnicom Group said Monday it has agreed to buy rival Interpublic Group in a merger that would create the world’s largest advertising agency.

The deal, which consists of an all-stock purchase, comes as the advertising industry continues to experience massive disruption at the hands of tech giants like Facebook, Google, and others that continue to dominate an industry once dominated by traditional ad agencies.

If the deal goes through, the combined Omnicom and Interpublic firms will employ more than 100,000 workers and bring in about $25 billion in annual revenue, giving it more leverage to take on tech and advertising rivals amid rising digital advertising and artificial intelligence in the space.

This could help the company increase its share of the growing advertising market. According to a new study from media buying giant Group M, advertising has made a comeback this year, surpassing $1 trillion in revenue and posting 9.5% growth.

While the firm predicted that advertising revenue would continue to grow in 2025 to $1.1 trillion, it said that just five companies — Google, Meta, TikTok owner ByteDance, Amazon and Alibaba — will account for more than half of all global advertising revenue.

Shares of Omnicom fell nearly 7% in late morning trading after Interpublic shares rose more than 9% on Monday.

Omnicom Chief Executive John Wren said the acquisition of Interpublic would “take advantage of the significant opportunities created by new technologies in this era of exponential change.”

Under the deal, which is expected to close in the second half of 2025, Omnicom shareholders would own approximately 60% of the combined company, with Interpublic shareholders holding the rest.

Omnicom executives said they had “clearly identified opportunities” for $750 million in annual cost savings. The combined company would be called Omnicom, they added.

In recent years, Interpublic has struggled and lost a handful of critical customers, including Verizon and BMW. The firm’s revenue was flat in 2023 compared to 2022, and it forecast growth of just 1% for 2024.

To generate cash, the company has moved to sell its underperforming agencies, including Huge and R/GA. Last week, Interpublic sold Huge to private equity firm AEA Investors for an undisclosed sum. However, it has not provided a status update on the R/GA sale.

Critics speculate that the massive deal could raise regulatory scrutiny.

Although President-elect Donald Trump has shown he can embrace more mergers and acquisitions, his selection of Gail Slater to lead the Justice Department’s antitrust division signals to many that he plans to continue the Biden administration’s crackdown on technology industry deals.

Omicom and Publicis attempted to merge in 2013, citing the threat of technology disruption, but the massive deal proved unmanageable due to all the subsidiary companies involved, and eventually fell apart.

The same thing could happen again, according to analysts at Bernstein.

“Common sense suggests such a large merger would create significant execution challenges from a customer and talent retention perspective,” the analysts said in a note.

Interpublic was founded in 1930 by the merger of the McCann and Erickson advertising agencies. It owns well-known advertising firms including McCann Worldwide and ad-buying giant IPG Mediabrands.

Omnicom was created in 1986 as part of a larger merger of advertising agencies including BBDO Worldwide.

It currently owns agencies TBWA, OMD and digital commerce company Flywheel.

#Omnicom #buy #Interpublic #deal #create #worlds #largest #advertising #agency

Image Source : nypost.com